A Quality of Earnings (QoE) report assesses the accuracy and sustainability of a company’s earnings, removing distortions to focus on core operational performance. It provides insights into the reality behind financial statements, helping investors and lenders validate key financial data. QoE reports are essential for M&A transactions and investment decisions, ensuring stakeholders understand the true financial health of a business. Example PDFs of QoE reports often include detailed financial analysis, trend assessments, and normalizations to highlight earnings quality.

Definition and Purpose of QoE Reports

A Quality of Earnings (QoE) report is a detailed financial analysis that evaluates the accuracy, sustainability, and quality of a company’s reported earnings. Its primary purpose is to provide stakeholders with a clear understanding of a company’s true financial performance by identifying and adjusting for distortions, one-time events, or non-recurring items. QoE reports are essential for investors, lenders, and acquirers to assess the reliability of financial statements and make informed decisions. They focus on distinguishing between core earnings and non-operational factors, ensuring a transparent view of a company’s financial health. By clarifying the sustainability of earnings, QoE reports play a critical role in M&A transactions and investment evaluations, helping stakeholders avoid potential risks and misrepresentations.

Importance of QoE in Financial Decision-Making

The Quality of Earnings (QoE) report is a cornerstone of informed financial decision-making, enabling stakeholders to evaluate a company’s true operational performance. By distinguishing between sustainable and non-recurring earnings, QoE analysis helps investors and lenders assess risks and opportunities more accurately. In M&A transactions, QoE reports are indispensable for identifying potential synergies or red flags, ensuring that valuations are based on reliable financial data. Additionally, QoE insights guide strategic planning and resource allocation by highlighting a company’s ability to generate consistent cash flows. Its importance lies in providing transparency and clarity, which are critical for building trust and confidence among stakeholders, ultimately driving better financial outcomes and safeguarding investments.

Components of a Quality of Earnings Report

A Quality of Earnings report includes revenue analysis, expense reviews, cash flow assessments, and adjustments to identify sustainable earnings and profitability trends, ensuring clarity on core operations.

Revenue Analysis and Trend Assessment

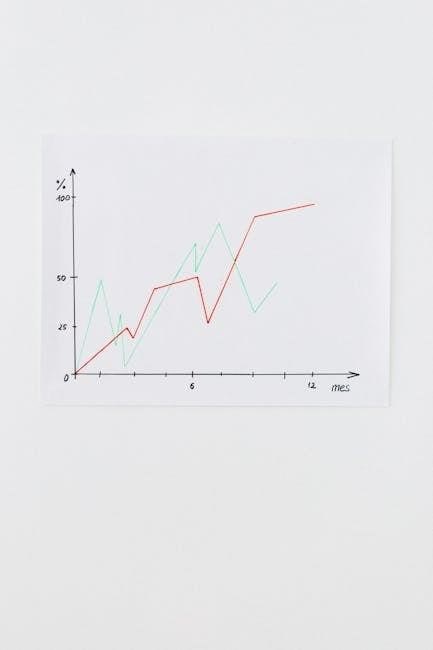

Revenue analysis in a QoE report examines the sources and sustainability of a company’s income, distinguishing between core operations and one-time gains. This assessment identifies trends, such as consistent growth or declining sales, by comparing historical data. Analysts evaluate revenue recognition practices to ensure compliance with accounting standards. They also analyze pricing strategies, volume changes, and market conditions impacting revenue. The report highlights whether revenue growth aligns with profitability, revealing potential disconnects. Normalizations may adjust for unusual items to reflect recurring earnings. This section provides insights into the quality and reliability of revenue streams, helping stakeholders assess the company’s financial health and future prospects. It ensures clarity on whether growth is driven by sustainable operations or temporary factors.

Expense Review and Profitability Metrics

An expense review in a QoE report evaluates the nature and sustainability of a company’s costs, ensuring they align with revenue growth. This analysis examines key profitability metrics such as gross margin, operating expense ratios, and EBITDA. By identifying unusual or non-recurring expense items, the report adjusts financial statements to reflect normalized earnings. This process reveals whether profitability is driven by operational efficiency or temporary factors. The review also assesses cost structures to determine if they are scalable or indicative of underlying inefficiencies. Such insights help stakeholders evaluate the sustainability of earnings and the company’s ability to maintain profitability in the future. This section is critical for understanding the true financial health and cost management practices of the business.

Cash Flow Analysis and Working Capital Management

Cash flow analysis in a QoE report examines the company’s ability to generate and manage cash, ensuring liquidity and operational efficiency. It evaluates operating, investing, and financing cash flows to identify trends and anomalies. Working capital management is critical, as it assesses how effectively the company manages short-term assets and liabilities. Metrics like days sales outstanding (DSO), inventory turnover, and cash conversion rates provide insights into cash flow health. The report highlights any discrepancies between reported earnings and actual cash flows, revealing potential issues in cash management. This analysis helps stakeholders understand the company’s ability to sustain operations and invest in growth, ensuring alignment between financial statements and real-world cash flow dynamics.

Conducting a Quality of Earnings Analysis

A QoE analysis involves a thorough review of financial statements, identification of adjustments, and evaluation of earnings sustainability to validate reported figures and detect potential risks.

Data Collection and Financial Statement Review

The process begins with gathering historical financial statements, including income statements, balance sheets, and cash flow statements. Analysts review these documents to understand the company’s reported performance and identify potential discrepancies or anomalies. They also collect additional data, such as industry benchmarks, market trends, and operational metrics, to contextualize the financial results. A thorough review of notes to the financial statements is conducted to uncover hidden risks or unusual accounting practices. This step is critical for ensuring the accuracy and reliability of the data used in the QoE analysis, as it forms the foundation for identifying adjustments and normalizations in subsequent stages.

Identifying Adjustments and Normalizations

In a Quality of Earnings (QoE) analysis, identifying adjustments and normalizations is crucial to understanding the sustainability of a company’s earnings. Adjustments involve correcting errors or aligning financial statements with accounting standards, while normalizations remove one-time or non-recurring items to reflect the company’s core operational performance. Analysts review financial statements, footnotes, and management commentary to identify such items. For example, adjustments might include correcting misstatements or reallocating expenses, while normalizations could involve excluding non-recurring gains or losses. These steps ensure that the reported earnings align with the company’s true financial health, providing stakeholders with a clear and accurate picture of its performance. This process is essential for making informed decisions in mergers, acquisitions, or investments.

Evaluating Sustainability of Earnings

Evaluating the sustainability of earnings is a critical component of a Quality of Earnings (QoE) analysis. It involves assessing whether the reported earnings are likely to continue into the future. Analysts examine trends in revenue, profitability margins, and cash flow to determine consistency and reliability. For example, a company with stable revenue growth and consistent profit margins may have more sustainable earnings. Conversely, earnings heavily reliant on one-time gains or non-recurring items may be less sustainable. Adjustments and normalizations help isolate core earnings, providing clarity on the business’s ability to generate future profits. This evaluation is essential for investors and acquirers to forecast performance and make informed decisions. Sustainability analysis ensures stakeholders understand the long-term viability of the company’s financial health.

Example of a Quality of Earnings Report

A QoE report example provides a clear structure for assessing a company’s financial health. It includes revenue analysis, expense review, and cash flow assessment, offering insights into core earnings sustainability.

Sample QoE Report Structure and Content

A Quality of Earnings (QoE) report typically includes a detailed assessment of a company’s financial performance. It begins with an executive summary highlighting key findings. The report then dives into revenue analysis, examining trends, customer concentrations, and contract terms. An expense review follows, evaluating cost structures and identifying unusual or non-recurring items. Cash flow analysis is another critical component, ensuring that reported earnings align with actual cash generation. The report also outlines adjustments and normalizations, such as removing one-time gains or losses. Finally, it concludes with an assessment of earnings sustainability and recommendations for stakeholders. Example PDFs of QoE reports often include visual aids like charts and tables to enhance clarity.

Case Study: Applying QoE in M&A Transactions

In mergers and acquisitions, a Quality of Earnings (QoE) report is essential for verifying the accuracy of a target company’s financial performance. For instance, during an acquisition, analysts use QoE to identify risks such as revenue recognition issues or unsustainable profit margins. A case study involving a tech company revealed that its reported earnings were inflated due to one-time gains, which a QoE analysis uncovered. This insight allowed the acquirer to renegotiate the valuation, saving millions. The report included a detailed revenue analysis, expense review, and cash flow adjustments, providing a clear picture of the company’s true financial health. Such examples demonstrate how QoE reports are indispensable for informed decision-making in M&A transactions, ensuring alignment with strategic and financial goals. Example PDFs of QoE reports often highlight these real-world applications.